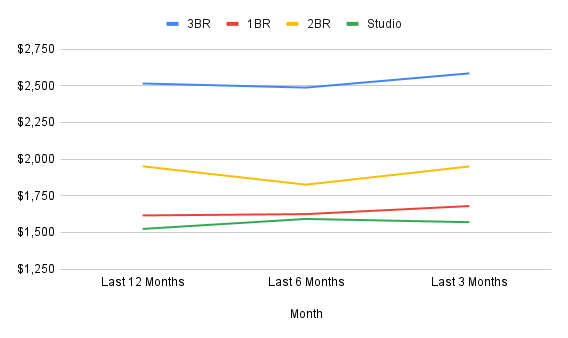

Reno market rental trends report

Reno's rental market has cooled slightly over the last 3 months. Studio and 1 bedroom apartments have dropped 7-16% while 2 bedrooms and larger homes...

Over the past 3-6 months, Sacramento’s rental market has been relatively stable with slight cooling in rents, showing minimal month‑to‑month movement and in some measures small decreases in average asking rents. Data from Zillow and local trend reports indicate that average rents have not moved significantly in late 2025 compared with earlier in the year, reflecting a flattening of prices. This subdued change is largely due to balanced supply and demand dynamics, where modest increases in available rental inventory and a more moderate pace of renter demand have offset pressures that typically push prices higher. Local vacancy trends and a “cool” market temperature suggest renters have more options, reducing upward rent pressure. Currently, the median rent in Sacramento is approximately $1,815 per month across all unit types, highlighting its position as a more affordable California rental market relative to other major metros.

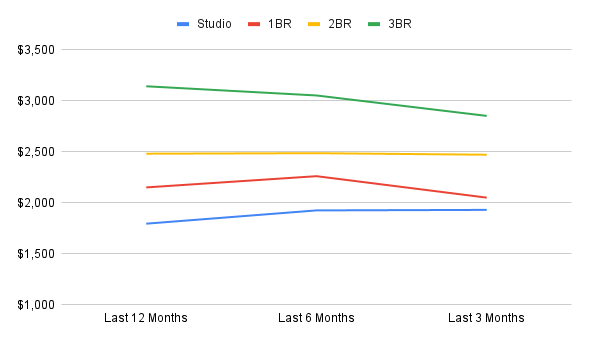

Folsom

Over the past 3-6 months, rental prices in Folsom have been relatively stable to modestly soft. Recent inventory‑based reporting suggests rent levels have edged only marginally higher in certain segments, while other measures show virtually flat to decreasing pricing overall. This muted change reflects a combination of balanced supply and demand, where new listings and available units have helped temper sharper rent growth, even as demand remains supported by Folsom’s quality of life, strong local economy, and proximity to Sacramento. At the same time, broader economic forces — including affordability constraints and wage pressures — are limiting landlords’ ability to push rents significantly higher. As of early 2026, the current median rent in Folsom across all unit types is roughly $2,260 per month.

Apartment listings

Below are some recent listing examples.

Folsom

(Data sourced from Apartments.com)

Reno's rental market has cooled slightly over the last 3 months. Studio and 1 bedroom apartments have dropped 7-16% while 2 bedrooms and larger homes...

.jpg)

Over the past 3–6 months, Raleigh’s rental market has shifted from a brief period of softening into a clear upward trend, with average rents...

Over the past 3–6 months, rent prices in Columbus have remained relatively stable with modest pressure rather than strong increases, reflecting a...