Reno market rental trends report

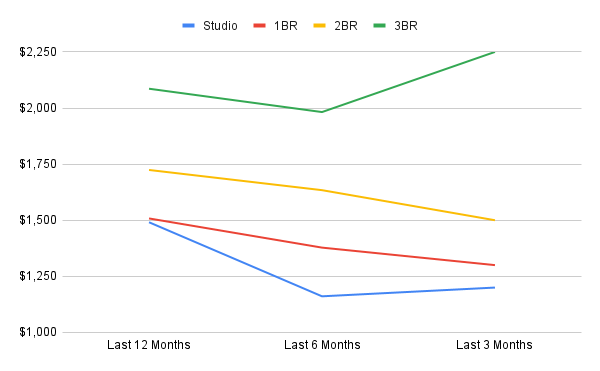

Reno's rental market has cooled slightly over the last 3 months. Studio and 1 bedroom apartments have dropped 7-16% while 2 bedrooms and larger homes...

.jpg)

Over the past 3 to 6 months, rents in Raleigh have continued to edge upward across most unit types, with median rents rising especially in studios and one-bedroom units. According to a recent market trends report, median studio rents rose ~15.1 %, one-bedroom ~10 %, two-bedroom ~6.3 %, and three-bedroom ~9.1 % over the last half-year. The upward pressure has largely been driven by strong population and job growth in the Triangle region, constrained new housing supply in desirable submarkets, and persistent demand from renters delaying home purchases amid interest rate uncertainty. Today, the median rent across Raleigh’s rental market is approximately $1,702/month.

Apartment listings

Below are some recent listing examples.

(Data sourced from Apartments.com)

Reno's rental market has cooled slightly over the last 3 months. Studio and 1 bedroom apartments have dropped 7-16% while 2 bedrooms and larger homes...

Over the past 3–6 months, rent prices in Columbus have shown modest upward pressure, with average rents inching higher in many segments. This...

The Denver rental market over the past 3-6 months is showing signs of cooling after a multi-year stretch of strong growth. Rents in many segments are...